Pattern Analytics and Monitoring for Banking and Finance

Front Line Enablement

Self-service pattern discovery and analysis for business professionals.

Empower researchers and technical analysts to discover, analyze, and search for anomalous or recurring patterns in financial data, and also to create and share libraries of such patterns.

Back End Automation

Automate monitoring and signal alerting across thousands of trading assets.

Monitor for individual patterns or deploy artificial logical networks to predict events in trade surveillance, high frequency trading operations, AML and fraud monitoring applications.

Social Trading

Democratize chart pattern strategies and track their returns in real time.

Gen Z traders demand a different, game like experience. They want to mimic successful strategies fast. Patter based strategies are easy to understand and easy to rank in real time.

Monetization

Get clues on all financial activities – from trading to AML and intrusion detection.

Granular financial data is rich in actionable insights. Discovering and monitoring them at scale allows to uncover new opportunities, prevent crimes, and gamify your consumer trading applications.

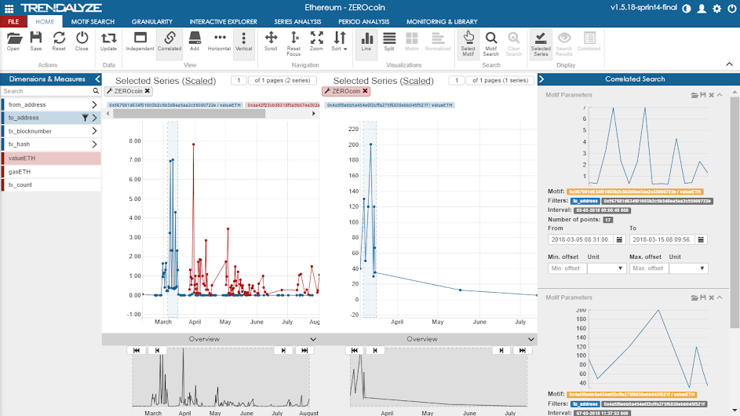

Trendalyze finds instantly price manipulation patterns within 80,000,000 crypto wallets.

ICO scams typically pump the value of a project by increasing the demand for the underlying utility token prior to the public ICO sale.

Bots are used to generate a large number of trading accounts creating the perception for high demand. Trendalyze helps companies and regulatory agencies to detect the bot patterns that simulate high transaction volumes. The same method is applicable for money laundering monitoring through apps and P2P exchanges.